A closed-end fund (CEF) is one of several types of several investment vehicles that provide convenient way to acquire a broadly diversified portfolio. The typical CEF is actively managed and specializes in a particular asset class such as stocks, convertible bonds, or municipal bonds. CEFs and investment companies that manage them are subject to Securities and Exchange Commission regulation. CEFs generally pay monthly or quarterly distributions that may be made up of dividend or interest income on their holdings, capital gains, and return of capital.

Closed-End Funds vs. Open-End Mutual Funds

Closed-end funds share some characteristics with open-end mutual funds, which most investors are probably more familiar with, but differ in certain fundamental ways.

When you buy or redeem shares of an open-end mutual fund, the party on the other side of the transaction is the fund’s manager. Transactions occur at the day’s closing net asset value (NAV), i.e., the value of the fund’s underlying assets divided by the number of outstanding shares. The number of shares in the market increases when you purchase shares from the manager and decreases when you redeem shares.

Trading and Pricing of Closed-End Funds

In contrast, CEF shares are traded like stocks, with another investor or a broker-dealer selling the shares that you buy or buying the shares that you sell. Trades in CEFs ordinarily have no effect on the number of shares outstanding. (An exception involves a sale into a tender offer by the management company.)CEFs are allowed to hold a higher percentage of illiquid securities than open-end mutual funds are. In addition, many CEFs use borrowed funds (“leverage”) in an effort to increase their returns. Even more important, a CEF’s price varies over the course of a trading session, as determined by market forces. It may therefore trade at either a premium or a discount to NAV.

Opportunities and Risks of Investing in Closed-End Funds

The possibility of buying a CEF at a discount to NAV creates potential for capturing a gain not through a rise in the NAV, but also as a result of the market narrowing the price-versus-NAV gap by boosting the price. Encouragingly, as well, you may not have to wait for the gap to narrow through millions of investors concluding that the CEF shares are undervalued. If the discount becomes large enough, an activist hedge fund may launch a takeover bid, driving up the CEF’s price.

Note, however, that buying a CEF at a discount to NAV does not ensure that you will achieve a “bonus” price gain, in the short run or ever. A modest discount may not reflect an objectively demonstrable mispricing arising from market inefficiency, but rather persistently substandard performance by the manager. In that case, the discount may persist indefinitely, with no hedge fund stepping forward with a tender offer.

Investment Performance

As noted above, many CEFs seek to boost their returns by using borrowed capital. This strategy is similar to an individual investor buying securities on margin, thereby gaining control over a larger amount of market value than would be possible using only his or her own capital. For both the CEF manager and the margin user, leverage cuts two ways—amplifying gains and magnifying losses.

Leverage and Income-Generating CEFs

In the case of CEFs that cater to income-oriented investors, leverage can greatly increase yield from the rate of current income on the fund’s underlying assets. For example, the average indicated yield on the 22 closed-end funds in the Previous Recommendations section of the Forbes/Fridson Income Securities Investor newsletter as of December 31, 2022 was 9.32%. That compared with yields on the same date of 3.83% on the benchmark ten-year US Treasury bond, 4.88% on AA corporate bonds, and 8.87% on high yield (speculative grade) corporate bonds, as reported by ICE Indices, LLC.

Performance and Volatility

In fixed income, yield is what is promised; total return is what you get. Likewise for equity-oriented CEFs, realized returns may not match investors’ expectations, owing to leverage’s magnifying effect on losses in down markets. Additionally, individual CEFs’ performance may vary widely from the group average according to their managers’ skill in sector asset allocation and security selection. Accordingly, your results in the CEF category will depend on the particular CEF(s) that you choose for your portfolio.

The Closed-End Fund Association provides a useful tool that underscores the importance of making well-informed choices within the large universe of CEFs. Its Composite Closed-End Fund Index is designed to be a benchmark for funds that aim to generate taxable annual income.

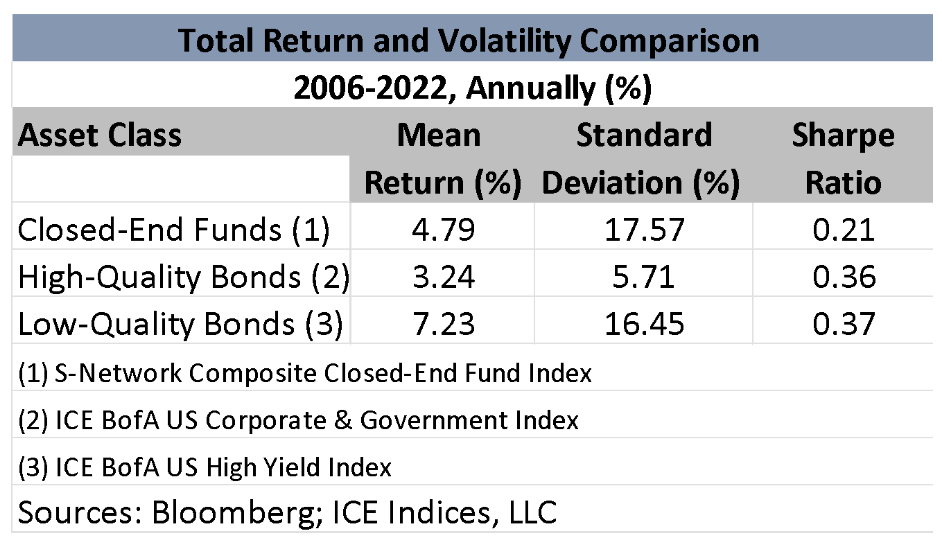

As detailed in the accompanying table, CEFs delivered a higher average annual return than high-quality bonds over the period 2006-2022—4.79% versus 3.24%. That edge in return, however, came at a price of three times as much volatility, as measured by standard deviation—17.57% versus 5.71%. As a group, CEFs were more volatile even than low-quality (speculative grade) bonds, which produced a substantially higher average annual return.

The Sharpe Ratio: Assessing Risk-Adjusted Returns

The Sharpe Ratio is a summary statistic that measures how much total return bang investors get for the volatility buck. It is calculated by subtracting the risk-free return from the asset category’s mean return and dividing by its standard deviation. For the risk-free return, we used the mean annual return on three-month Treasury bills, which was 1.18%, as reported by ICE Indices, LLC.

The combination of a high average return and low volatility produces a high Sharpe ratio. That is the kind of outcome most investors prefer. Unfortunately, just buying a random sample of CEFs is unlikely to deliver the desired outcome. During the period for which the Closed-End Fund Index’s returns are available, high-quality bonds’ Sharpe ratio was considerably higher than CEFs’—0.36 versus 0.21. Low-quality bonds, with a much higher average annual return than CEFs, also offered a superior risk-reward tradeoff, as indicated by a 0.37 Sharpe ratio.

Conclusion

Closed-end funds can help you achieve your investment objectives, but care in choosing the right ones is essential. One important consideration is the amount of leverage employed by the manager. Another factor to take into account is the CEF’s historical record with respect to generating high returns while limiting volatility. Past success by those criteria does not guarantee good results in the future, but by the same token, it ordinarily takes a leap of faith to believe that the same team that performed poorly in prior years will turn things around in the coming period. Finally, the opportunity to buy a CEF at a discount to NAV is potential, but by no means a guaranteed path to obtaining an extra bump to total return.