A master limited partnership (MLP) is a public, exchange-traded investment vehicle. Its profits are not taxed at the company level, provided at least 90% of that income is generated from qualifying sources. Those sources include production, processing, storage, and transportation of depleting natural resources and minerals, as well as rents on real property. The asset class is particularly associated with pipelines that transport crude oil, natural gas, or refined products.

Understanding Master Limited Partnerships (MLPs)

MLPs’ Tax Advantages

MLPs appeal to investors derives from their ability generally to provide high and steady income, of which as much as 80% or 90% may be tax-deferred. The limited partners of MLPs are analogous to corporations’ stockholders, but they own units rather than shares. MLPs’ partnership agreements typically specify that distributions to unitholders shall consist of all available cash flow, minus a reserve determined by the general partner, which manages the MLP’s operations.

Disadvantages of MLPs

One disadvantage of MLPs is that they issue annual Schedule K-1 forms to unitholders. These often complex documents detail the MLP’s income, deductions, credits, and other data. K-1s create extra work for taxpayers or the professionals they hire to handle their tax returns.

MLPs in Tax-Deferred Accounts: Weighing the Pros and Cons

Tax Treatment of MLP Distributions

Income Securities Advisors does not offer tax advice. Investors should consult their tax advisors on questions such as the suitability of MLPs for their portfolios and the treatment of MLP distributions and price changes for income tax and estate tax purposes.

Portions of MLPs’ distributions are deemed return of capital. Cash received as return of capital is not taxed, but it reduces the holder’s cost basis. That increases the holder’s calculated capital gain—if any—when the MLP units are subsequently sold. The impact of the reduction in cost basis can be eliminated if the units are bequeathed upon the holder’s death. In that case the inheritor’s cost basis is stepped up to the units’ then-prevailing price. No such step-up of cost basis occurs if the units are gifted.

Tax Implications for Tax-Deferred Accounts

Investors often ask whether it is appropriate to own MLPs in a tax-deferred account such as an Individual Retirement Account (IRA). The argument against doing so is that a portion of MLP distributions paid to an IRA are subject to “unrelated business income tax” (UBIT). An IRA’s UBTI is its share of the MLP’s taxable business income, less its share of the MLP’s depreciation and other business deductions.

Strategies for Tax-Deferred Accounts

The first $1,000 of UBTI that an IRA receives from all sources, however, is not subject to taxation. Limiting the size of MLP investments is therefore a way to obtain their high-income benefits within an IRA without incurring unfavorable tax consequences. Another way to achieve that kind of result is for an IRA to invest in one of several open-end or closed-end mutual funds that buy MLS and pass the income on to their shareholders as dividends. Yet one more approach is to invest in publicly traded affiliates maintained by some MLPs. They are taxed as corporations.

Historical Performance and Volatility of MLPs

Historical Performance

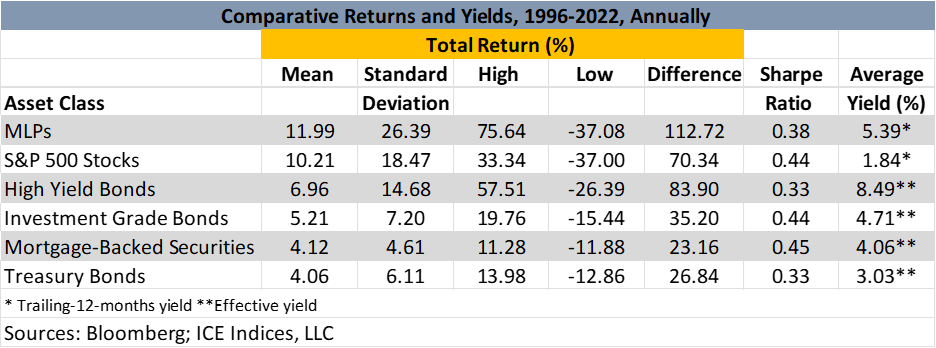

The table below shows how the Alerian MLP Index’s historical performance compares with indexes of other major investment categories. Over the 27-year period shown, MLPs yielded more on average (5.39%) than any other asset class listed here except for high yield (speculative grade) corporate bonds. Measured by mean (simple average) total return, which takes into account income, reinvestment of income, and price change, MLPs topped all the categories, at 11.99%.

Long-term Performance and Risk

While delivering high current income, MLPs produced a higher average annual return than even common stocks, the look-to asset class for investors seeking long-term appreciation. That sounds like a sensational investment, but there is an important caveat.

The Ups and Downs of MLP Performance

MLPs’ high mean total return was fattened by an off-the-chart 75.64% return in 2009, by far the highest of any of the asset classes in any year. That eye-popping result followed a -37.08% return just one year earlier (2008), in the throes of the Great Recession.

Long-term MLP holders achieve less spectacular results than the mean total return figure implies. From the end of 1995 through the end of 2022, the Alerian MLP Index appreciated at a rate of just 3.0% a year. That compares with 6.5% over the same period for the S&P 500. From the beginning through the end of our 26-year observation period, the Alerian MLP Index provided an annualized total return of 8.51%, well below the 11.99% mean annual return shown in the table. The comparable figure for the S&P 500 was 9.02%, with a considerably lower level of current income along the way, but with a higher Sharpe Ratio (0.44 versus 0.38).

Considering Volatility and Risk Factors

In theory, investors could still make out phenomenally well by selling MLPs at market tops and buying them at the low points in price. As a practical matter, though, few if any investors—including professionals—consistently succeed with market-timing strategies.

Clearly, investors need to consider the risk-versus-reward tradeoff in deciding how much of their portfolio to allocate to MLPs. In the same year that the Alerian MLP Index recorded its worst annual return of -37.08%, Treasury bonds delivered their highest return of the period, 13.98%. The 9.17% price gain included in the Treasury total return represented something of a reward for investors who had settled for lower current income than they could have earned by owning MLPs.

The broader point is that MLPs had by far the highest volatility among asset classes depicted in the table, measured by standard deviation (26.99%). They also exhibited the biggest gap between best- and worst-year return—112.72 percentage points. At the other extreme, the best-to-worst differential for mortgage-backed securities was just 23.16 percentage points.

To compare asset classes’ total returns on a risk-adjusted basis, investors can refer to the Sharpe Ratio. This measure subtracts the risk-free return from the asset class’s mean return and divides by the standard deviation. For the risk-free return, the calculations reflected in the table use the 2.06% mean return for the period on three-month Treasury bills. On a risk-adjusted-return basis, MLPs at 0.38 were about in the middle of the pack between Mortgage-Backed Securities (0.45) and both Treasury and high yield bonds at 0.33.

Sensitivity to Energy Prices

In bygone years, proponents of MLP sought to dispel potential investors’ fears that they would be exposing themselves to notoriously volatile oil and gas prices. They explained that in the case of pipeline operators, company revenues were based on volumes (barrels of oil or British thermal units of natural gas) transported, not on the price at which the fuel was sold. Many of the pipelines’ contracts were take-or-pay contracts, meaning that oil or gas producer had to pay the pipeline whether it shipped the commodity or not. Or, in the case of a refinery, whether or not it took delivery.

Changing Energy Price Dynamics

Those representations of MLPs’ insulation from energy price fluctuations were valid in the past. For the period 1997-2009 the correlation between the Alerian MLP Index’s annual return and the year-over-year change in the crude oil price (as measured by the Generic 1st Crude Oil, West Texas Intermediate contract) was just 16%. That correlation soared to 72%, however, in 2010-2022. Investors could no longer be confident that the prices of their pipeline-related MLPs would hold steady in the face of a sharp decline in oil and gas prices. The change reflected at least in part a growing concern that in a sufficiently drastic energy price decline, many oil and gas producers would go bankrupt and consequently would not make good on their contractual obligations to pay for use of the pipelines.

Conclusion

Master Limited Partnerships can be an excellent portfolio element for tax-sensitive investors seeking high current income. A long-run perspective is advisable in owning MLPs, as they are subject to wide year-to-year price swings, tied in part to erratic oil and gas prices. It is also important to keep in mind the added burden on tax filing that arises from the Schedule K-1 forms issued by MLPs