A Second Reason to Consider Bonds: Portfolio Balance

We previously discussed the primary objective of many individuals who invest in bonds, namely, current income. Stocks generate a higher total return than bonds over time, but their return comes primarily in the form of price appreciation, rather than from dividends. In contrast, long-run bond returns are all derived from interest payments—also known as “coupons.” As of March 15, 2023, a $100,000 investment in the Standard & Poor’s 500 Index of common stocks was expected to generate just $1,720 of cash over the succeeding 12 months. The comparable figure for the ICE BofA US Corporate & Government Index of investment grade corporate bonds was $4,500.

The following discussion highlights a second reason to consider bonds as part of your investment plan. Owing bonds enables you to balance risks within a portfolio and reduce the volatility of its returns. This is the result of investors acting differently at different points in the business cycle.

Why Stock and Bond Prices Move Differently

When investors believe the economy is weakening, they lower their projections of corporate earnings and, in turn, their valuations of common stocks. At the same time, investors expect that loan demand will decline. They reason that consumers will defer planned purchases of big-ticket items and businesses will cut back on expansion plans in view of an expected drop in demand for their goods and services.

Reduced demand for debt financing causes interest rates—including bond yields—to decline. When bond yields fall, bond prices rise. Consequently, by owning bonds, you can offset declines in stock prices during bad economic times.

Quantifying the Benefit

The preceding discussion is not just a hypothetical description of what logically ought to happen, but a scenario that has been validated in practice. For example, when stock prices fell for three consecutive years from 2000 to 2002, the Standard & Poor’s 500 Index posted a -14.52% annualized return. Over that same span, the ICE BofA US Corporate & Government Index’s annualized return was 6.66%. Bonds certainly lived up to their reputation as a stabilizing force in that instance.

Over the long run, reassuringly, both asset classes deliver positive total returns. For the period 2003-2022, the annualized figures were 9.78% for stocks and 3.73% for bonds. Bonds fared better in terms of relative return in the previous 20-year period, when average yields were higher, at 8.40% annualized versus 12.72% for stocks. In both periods, though, stocks returned more than bonds, so what long-run benefit was there in owning bonds?

Mitigating Risk: The Benefits of Diversification

It is true that if you truly care only about amassing the greatest possible wealth over a very long period, then a 100% stock portfolio is the way to go. Not every investor, though, can stomach the kinds of price swings that an all-equity strategy entails. Supposed you had held all of your wealth in the S&P 500 at the end of 2007. You would have seen 38% of your wealth wiped out over the subsequent year, not taking into account the minor dividend income for the year. You could have mitigated that loss, however, by diversifying with the ICE BofA US Corporate & Government Index. Its price eroded by a negligible 0.27% in 2008.

You may pride yourself on calmly ignoring the stock market’s interim ups and downs fearlessly focusing solely on your long-term investment goals. It is not necessarily the case, however, that investors who do worry about their portfolios’ shorter-run performance are succumbing to emotion and therefore behaving irrationally. They may instead be conscious of the fact that a financial emergency might arise even as they try to maintain focus on their multi-decade wealth accumulation, The need to raise cash under such circumstances could be devastating if it were to arise during a low point in the stock market, with their portfolios lacking any bonds that could have cushioned the decline.

The Power of Bonds: Offset of Price Declines in Stocks

How effectively do bonds offset price declines in stocks? During the period 2003-2022, the price of the S&P 500 declined in 23 quarters. In 18 of those quarters—78% of the time—the bond index outperformed the stock index in terms of price change. In a slight majority of those quarters—12—the bond index actually went up as the stock index fell. The most dramatic instance of bonds offsetting the damage in stocks was in the fourth quarter of 2008, when the S&P 500 plunged by 22.56% while the ICE BofA US Corporate & Government Index rose by 4.35%—its biggest quarterly price gain of the entire period.

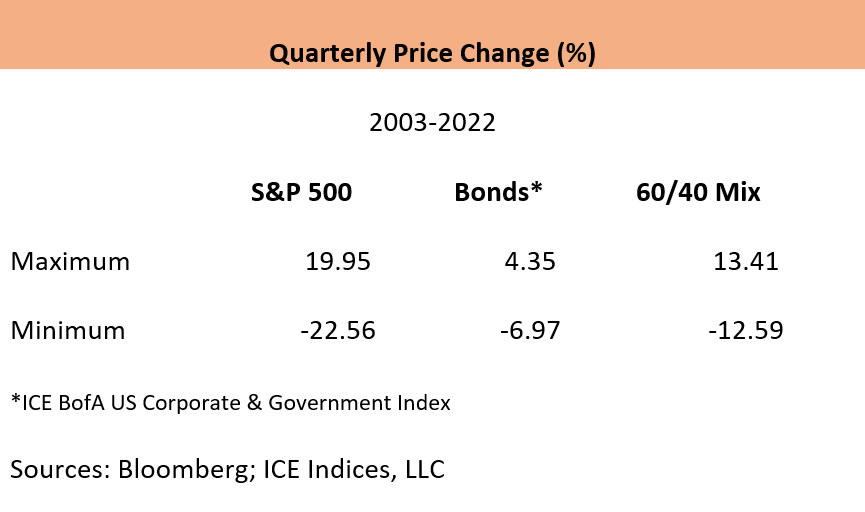

The graph below illustrates the extent to which adding bonds to an equity portfolio narrows the range of price swings. On a quarterly basis, the S&P 500’s maximum and minimum price changes varied over a range of 42.51 percentage points versus just 11.32 percentage points for bonds. One popular portfolio mix, 60% stocks and 40% bonds, reduced the range from stocks’ 42.51 percentage points to 26.00 percentage points.

The classic 60/40 mix is widely used as a performance benchmark. Some financial advisors recommend reducing equity exposure as you age. That can make sense if you plan upon retirement to begin liquidating part of your principal each year to meet living expenses. By shifting increasingly toward the more stable component, bonds, you can limit the impact of the stock market being at a low point when you reach retirement. Some advisors recommend lowering your stock allocation over time using the following formula:

Percentage Equity Allocation = 100 Minus Your Age

Note, however, that this formula-based allocation method is not necessarily appropriate for all investors, Some investors have sufficient income from pensions and stock dividends to last them for the rest of their lives. In effect, they may be investing on behalf of their heirs, who are a generation younger than themselves and for whom an equity allocation greater than that derived from the above formula is best suited.

These observations should not be construed as investment advice. Consult your investment advisor to determine the stock-bond allocation that best serves your own needs and objectives.

A Surprising Result

Note that up to this point we’ve focused on investment grade bonds—those rated AAA to BBB. It makes sense that they usually hold up better than equities—or even go up—during a stock market decline, as they’re seen as a comparatively safe haven in such times. Surprisingly, comparable consistency in cushioning falls in stock prices has been achieved with high yield bonds, rated BB or lower.

Commonly derided as “junk bonds,” these are assets that investors tend to reduce their exposure to when storm clouds gather. Nevertheless, over the 20-year period discussed above, the ICE BofA US High Yield Index posted a smaller price decline than the S&P 500 in 19 out of 23 quarters, or 83% of the time. In just under half of those quarters—11—the high yield index advanced in price. The conclusion is that even though financial theory states that high yield bonds have some equity-like characteristics, the debt-like component of their nature is prominent enough that they most often fulfill the portfolio-balancing role assigned to bonds.

Portfolio Balance Is a Long-Term Proposition

In summary, owning bonds is a means of reducing the period-to-period fluctuations in the value of your portfolio, compared with investing only in stocks. Achieving that objective entails a tradeoff, as the expected long-run return of a mixed stock-bond portfolio is lower than on a pure stock portfolio. It’s important to keep in mind, however, that holding bonds does not constitute a hedge that will invariably prevent short-term declines in value.

There have been entire years in which stocks and bonds both produced negative total returns. In 2022, for instance, total returns were -18.13% for the S&P 500, -15.44% for the abovementioned investment grade index, and -11.22% for the previously mentioned high yield bond index. Owning bonds does offer genuine potential for smoothing out performance, but it’s important to approach the idea with realistic expectations.