Understanding the Connection Between Inflation and Bond Yields

To understand why inflation and bond yields are connected, consider the familiar statement that inflation robs people who live on a fixed income. They include retirees who are dependent on their pensions. As the Consumer Price Index (CPI) rises, the dollars coming in to such individuals buy fewer of the goods and services they require.

Fixed Income and Investments

The same term, “fixed income,” is used to describe a whole category of investments, most prominently including bonds. These investments provide periodic payments of specified amounts. They differ from common stocks, the dividends of which can be raised, lowered, or suspended altogether by the companies’ directors.

Impact of Inflation on Bondholders

Some bonds’ semiannual interest payments adjust in line with a designated index of interest rates. For the more typical variety, however, the interest rate is set at the time of issuance and remains constant through the maturity date. If you own such a bond, your situation resembles the abovementioned pensioner’s. Inflation causes the purchasing power of your incoming dollars to shrink year by year.

How the Market Deals with Inflation

Bondholders are not oblivious to inflation’s depredations. In determining the interest rate they require in order to buy a bond, they consider two factors. First, they want some compensation for renting out their savings to borrowers, rather than using those dollars for current consumption. (In economists’ lingo, they expect to be rewarded for deferring gratification.) Second, they want to neutralize the effect of inflation, rather than receive interest payments and eventual return of their capital in dollars that do not stretch as far as the ones they lent.

The Fisher Equation

The economist Irving Fisher (1867-1947) formally described the impact of fixed income investors’ dual objectives. He separated the nominal interest rate – for example, the stated coupon percentage on a conventional bond—into the real interest rate and the inflation rate. The real (non-inflation-adjusted) interest rate is determined by the supply and demand of capital in the economy at a given time. 1Two additional factors come into play when discussing bonds issued by corporations or municipalities. Bond buyers demand additional yield premiums for the risk that the issuer will default, that is, fail to make scheduled interest or principal payments on time and in full.

They also demand a higher yield on corporate bonds to compensate for the lesser depth of their resale market, as compared to Treasury

bonds. This discussion is limited to U.S. Treasuries, which are considered free of default risk and have the deepest re-trading market of any class of securities.

Leaving aside some technicalities of calculation, the Fisher Equation comes down to:

Nominal Interest Rate = Real Interest Rate + Inflation Rate

Historical Relationship Between Inflation and Bond Yields

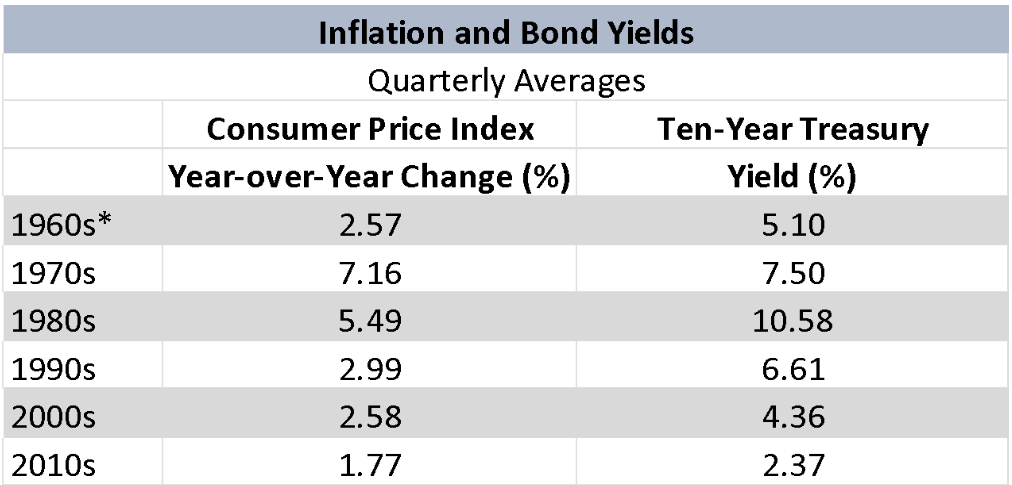

It is easy to demonstrate that this formula is no mere matter of economic theory, devoid of connection to the real world. The table below shows a clear relationship over time between inflation, as measured by year-over-year changes in the Consumer Price Index, and the yield on the benchmark ten-year Treasury bond.

*Beginning December 31, 1962

Source: Bloomberg

Inflation and Bond Yields

Quarterly Averages

Inflation soared between the late 1960s and the 1970s as the U.S. federal government pursued a “guns and butter” policy of funding the Vietnam War while continuing its high domestic expenditures. The quarterly average Treasury yield jumped by nearly 50% between the two decades and peaked in the 1980s. Average inflation declined in each of the next three decades and so did the average ten-year Treasury yield.

Correlation Between CPI and Treasury Yield

Coincidence? Not according to a standard statistical measure. For the full period covered by the chart, there was a 60.3% correlation between the average CPI change and the average Treasury yield. That is a level of correlation generally described as moderate, but it is too high to be dismissed as a chance, or spurious, correlation. Other factors also enter into the market’s setting of the yield on ten-year Treasuries. They include Federal Reserve efforts to maintain price stability, consistent with full employment, and investors’ expectations regarding recessions and economic recoveries.

Predictions for the Future

What Lies Ahead?

With less than half of the 2020s in the rearview mirror, it remains to be seen how well this decade will conform to the pattern shown in the table above. It would certainly be premature, however, to declare that the link between inflation and interest rates has somehow been severed. At the third-quarter 2020 low of 0.6% in year-over-year change in CPI, the ten-year Treasury yield stood at 0.66%. The comparable figures for the third quarter of 2023 were 3.7% and 4.57%, respectively. Time will tell whether the Fed’s aggressive interest rate hikes, beginning in March 2022, will reduce inflation to, or close to, the central bank’s 2% target. Regression analysis based on the historical data indicates that if that goal is achieved, the ten-year Treasury yield should average 4.55%. That would be a modestly favorable development for bondholders, as the rate has recently been flirting with the 5% threshold. (Bond prices rise when bond yields fall.)

Bond bears regard a longer-run 2% inflation rate as a mirage, based on the federal government’s massive federal deficits. The extreme view on the opposite side of the debate, encapsulated in Modern Monetary Theory, holds that deficits do not matter for a government such as the U.S. federal government, which issues its own fiat currency. (That is, money that is not backed by a physical commodity such as gold or silver, but solely by the issuing government’s credit.) Structural changes since the 1970s offer some reason to believe that the U.S. can avoid a wage-price spiral this time around. Specifically, a much smaller portion of the labor force is unionized than was the case 50 years ago and fewer collective bargaining agreements nowadays include cost-of-living-adjustment (COLA) clauses.

Investors who fear the worst on the inflation front do have some recourse within the default-risk-free Treasury market. The face value of Treasury Inflation-Protected Securities (TIPS) is pegged to CPI and can never be below the original principal amount. Interest payments on these obligations vary with the adjusted principal value of the bond. Owning TIPS is a means of protecting against the ravages of inflation inflicted on holders of conventional fixed income instruments.